Editor’s Note: All graphs in this post can be enlarged by simply clicking the image.

“It’s an incredible market.” “I don’t see it slowing.” “There’s lots of work out there.”

These are just a few comments we received anecdotally from readers when conducting our annual LM Industry Pulse report.

The survey results displayed within this story’s charts back up these remarks. The landscape market is on a roll with no sign of slowing down, landscape professionals say.

Ninety percent of respondents to the LM Industry Pulse survey call the industry very or relatively healthy—five points higher than last year and by far the highest number of respondents to answer that way since LM first started asking this question in 2011.

What’s helping

Some people point to the national economy to explain why things are going so well.

“If you look at the stock market, it’s the highest it’s ever been,” says Benjamin Bodnar, owner of Integrity Landscape Management in Stockbridge, Ga., referring to the Dow Jones Industrial Average’s highest closing record, set in early November.

Consumer confidence is also up. As of press time, the Conference Board’s Consumer Confidence Index is at a 17-year high and the University of Michigan’s Index of Consumer Sentiment has been at its highest levels since 2004, indicating future income and job prospects are driving discretionary purchases like landscaping.

Construction spending, a leading indicator for the landscape industry, was up about 4 percent for the first nine months of this year, compared to the same period in 2016, according to the U.S. Census Bureau. Though that growth is slightly less than expected, combined public and private construction spending has steadily climbed since 2012 and is expected to continue in 2018.

Other landscape professionals prefer to focus on their strong state or local economies to explain why they’re doing well.

“We are exploding,” says Hunter Blair, CEO of Yellow Rose Landscape Services in Carrollton, Texas, near Dallas. “There is so much construction going on here, and it’s been that way for the past three or four years.”

Texas state officials are actively recruiting companies to relocate there. It’s working—and it’s boosting business for Blair and others in the landscape industry.

Toyota, for example, is moving its North American headquarters to North Texas from Southern California.

“There’s a lot of housing going in in West Michigan,” Ben Kloosterman, vice president of Kloosterman Landscaping in Caledonia, Mich. “That’s usually what we go by to gauge things. Landscaping is at the tail end of home building.”

The $1.5-million company is up about 15 percent over last year.

In East Greenbush, N.Y., just outside of Albany, things are going well for Brad Rose Landscaping and the landscape industry as a whole, says co-owner and vice president Stephanie Leonard.

“If you have a good track record and you do right by your customers, you can have a booming business here,” she says, noting the economic stability is helped by the fact that the state government is located there. “We’re in a great area of the landscaping market.”

The same rings true in Washington state, according to Brian McKenna, team leader at Nature’s Caretaker, based in Belfair, Wash., with locations in other states, including Oregon, Idaho, Colorado, Texas and the Carolinas.

“Our local economy is very strong here,” he says. “It’s been on the upswing for about the last two years. Since 2010, it’s been progressively going up, but especially this year, it seems that people have wanted to invest more in their properties because they realize landscaping is considered an asset to their properties and increases the value.”

He recently spent several weeks at the company’s South Carolina location and observes “there’s more work there than there are companies to do the work.”

Such demand should pique price increases, and most contractors we spoke with say they had no problem bumping up prices in one area of their business or another.

In Grandview, Mo., near Kansas City, Terry Shaffer got no pushback on the price increases he implemented at Summit Lawn & Landscape this year. He increased hourly rates on irrigation maintenance by $5 per hour, and he also hiked wage rates on residential landscape maintenance services like mulching and shrub trimming.

Matt Medlock, owner of Backyard Retreats, Patios & Ponds in Westerville, Ohio, near Columbus, increased prices about 5 percent over last year and another 2.5 percent for 2018 and is satisfied with the results.

“I don’t get every project that I bid, but I’ve been really, really busy,” he says.

Derek Taussig, who calls the market in his area “booming,” raised residential mowing prices this year in line with demand with no problems.

“I plan to raise my landscape labor prices next year and to increase my markup on materials,” says the owner of Taussig Landscape, a full-service business in Manhattan, Kan. His plan is to combat increasing overhead costs and to increase pay as he closes in on the $1 million mark.

Taussig, who grew 30 percent in 2017, says he’s pulled back on advertising heading into 2018 because of his fast growth and backlog heading into next year.

He’s not alone. Other contractors report forgoing traditional advertising in favor of facilitating word-of-mouth marketing and being selective about clients in this time of high demand.

This year also seemed to be a year of no surprises in terms of operating costs. There were a few reports of persisting plant material shortages causing price increases, but no one cited major swings

in fuel prices or other products that fluctuate with petroleum prices, like fertilizer or irrigation supplies.

“We started out this year in the spring at $2.15 per gallon, and then because of the hurricanes (Harvey, Irma and Maria), we were bumped up to about $2.70, and then it fell back to about $2.50,” Leonard says. “We’re creeping back up because it always goes up in the winter months, but compared to what I was paying in 2013-2014, I’m not complaining about gas prices at all.”

The U.S. Energy Information Administration’s Short-Term Energy Outlook forecasts that U.S. regular gasoline retail prices will average $2.40 per gallon in 2017 and $2.45 per gallon in 2018. The agency is projecting diesel to come in at $2.65 and $2.83 this year and next.

Even insurance prices—including workers’ comp and liability—were predictable for the companies LM spoke to. Health insurance is often unpredictable and known for double-digit increases, but this year companies are finding ways to absorb or mitigate the costs to retain the benefit for their employees.

“Heath insurance is pretty high, and it’s been progressively going up, but we’re not willing to cut the benefits to the team members that utilize it,” McKenna says. “We’re hoping to work with the insurance company on a more proactive basis on keeping people healthy.”

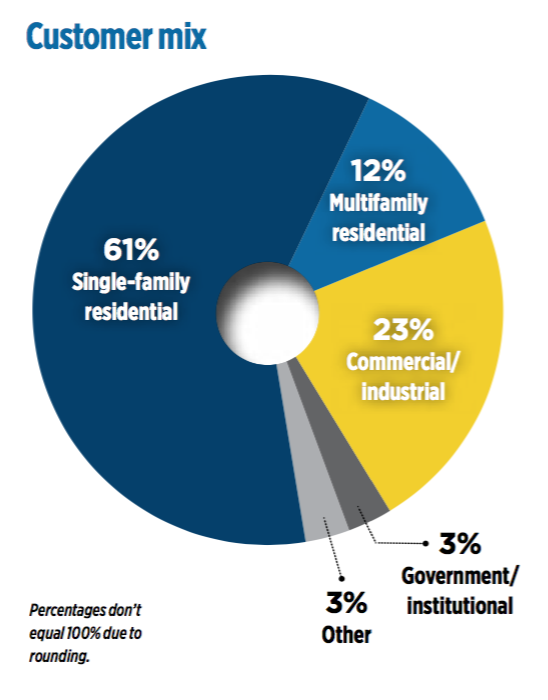

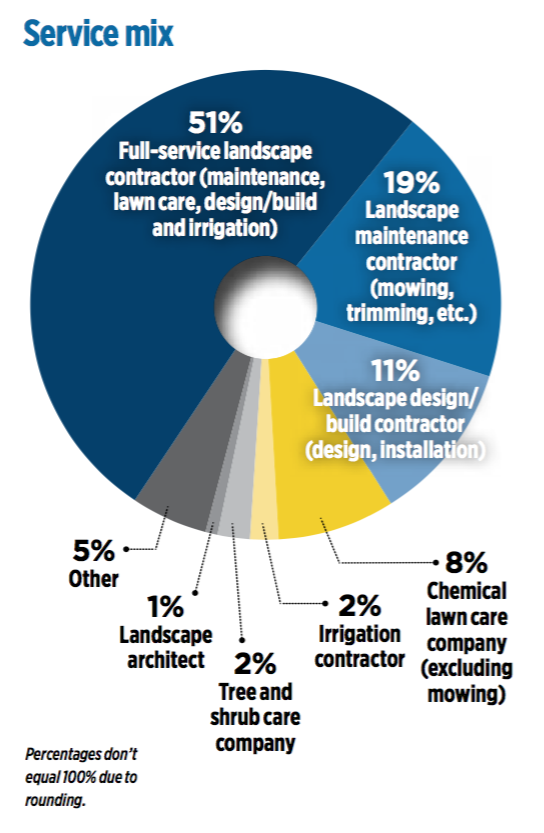

By the Numbers

What’s hurting

Despite the vitality of the industry and economy, there are challenges.

Not surprisingly, labor leads the way.

Companies large and small alike report that labor is their primary obstacle to growth.

Bodnar, for one, opted to downsize his company to be a one-man operation two years ago after struggling to retain a crew.

“Getting the new work isn’t that much of a challenge,” he says. “It’s getting the help on board that wants to stay for the long term. I’m finding that it’s more profitable right now for me to operate as a solo operator.”

Shaffer agrees. “Our biggest setback is staffing,” he says. His company will gross about $5.5 million this year. “I can hire salesmen and management positions all day, but we just can’t keep up with filling the crews. That’s why we have to stay with a slow 7-10 percent growth rate.”

It’s a challenge for McKenna, too. “Finding the right people is our limitation,” he says, reporting his company has been on a rocket ship ride nonetheless, growing from zero to $10 million at the company’s primary location alone in just a few years.

Shaffer has used the H-2B seasonal guest-worker program in the past, but he did away with it when the government nixed the returning-worker exemption, lowering the cap on the number of workers permitted per year. He may consider going back to it in the future to accommodate growth, but he decided to “sit tight” this year, considering potential changes in how the government handles the program, he says.

Yellow Rose, which has not used the H-2B program before, also may consider it next year, but Blair is hesitant. “You hear a lot of negative things about it,” he says, referring to the program’s constant changes and the uncertainty about whether or not government delays will prevent workers from arriving on time. “I’m not sure if that’s the route we want to go.”

The National Association of Landscape Professionals and other industry associations continue to lobby for “cap relief” for next year and permanent improvements to the program to make it more reliable for employers.

Regulations closer to home are another obstacle. For example, Nature’s Caretaker has all but opted out of doing business in the city of Seattle due to its employment restrictions. Because of the company’s size, it’s mandated to pay $15 per hour minimum wage and contribute to employees’ medical benefits, both of which McKenna says it does anyway. The stinger is the addition of a Paid Sick and Safe Time (PSST) Ordinance, which requires employers to offer employees additional paid leave that accrues at one hour of leave per 40 hours worked.

Others, like Leonard, see a higher minimum wage coming down the pike, as well.

“We’re in one of the states where they want to move minimum wage up to $15 per hour, and they have done so for fast food and national companies, where the mom and pops are on a five-year plan to move up incrementally.”

Mandated or not, she says, it makes sense to increase pay when you’re battling to attract employees.

“The pay is what gets people through the door, and what keeps them is how you treat them,” Leonard says.

Associate Editor Sarah Webb contributed to this report.

Methodology

For the 2017 Industry Pulse report, LM surveyed subscribers online in October and November, garnering 436 responses. Respondents were offered the chance to win one of three $100 gift cards as an incentive. Based on the number of responses, we assume a +/- 5 percent margin of error. Unless otherwise noted, all charts and figures in this report come from this survey.

Photo: ©istock.com/Photobvious